Since the COVID-19 pandemic, the fintech market has experienced a massive growth, valued at $305.7 billion in 2023.

Although the industry is constantly growing, there still are many challenges in fintech to resolve. Below, you’ll find out the most significant issues in fintech, their solutions, and modern opportunities.

3 challenges in fintech for startups

The global number of fintech startups was already 25,000+ by the end of 2021. However, not all of them have made the cut and are still present now. The challenges in fintech and missed opportunities are just too much for some. Let us have a closer look.

Fintech: “balloon” or “bubble”?

Considering the growing number of startups and investments, the fintech industry is more likely to be considered a “balloon”. Investors determine whether to fund a company based on its long-term capabilities. Thus, they approach the topic with thorough research.

For example, the total number of recorded investments in Europe grows each year. Only 1,847 investments were made in 2015, while 8,409 were made in 2022. This proves the growing number of opportunities and investors who are ready to support them.

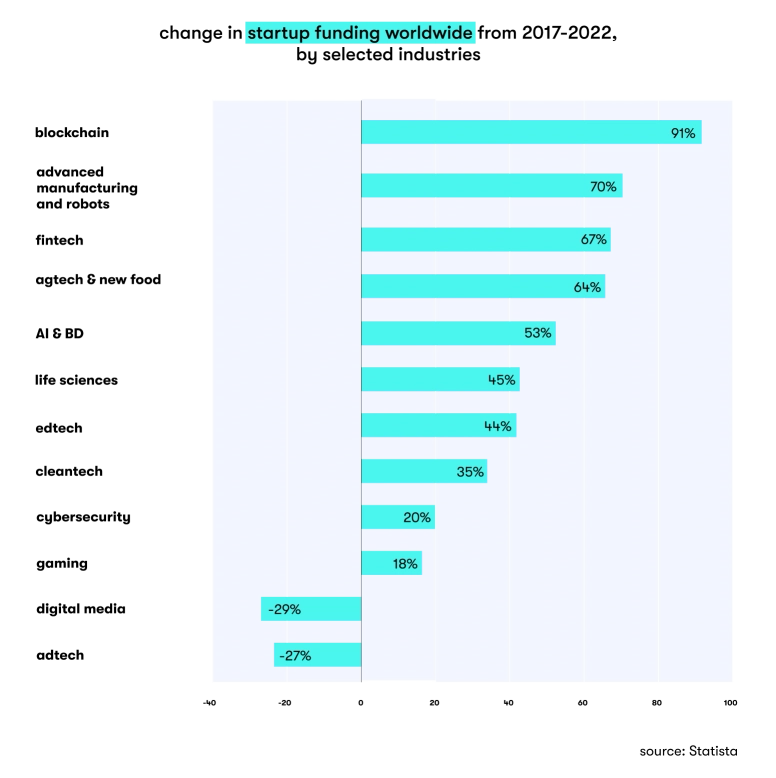

Emerging technologies like blockchain, machine learning, artificial intelligence, and Web 3.0 are what push the industry forward. They bring new solutions to the market and set new standards. That’s why these solutions are the major opportunities for fintech startups to compete with tech giants. However, challenges abound.

Raising venture capital

Venture capital is one of the key elements that make a startup grow. However, regardless of the increased interest in the industry, attracting the right investors is still a challenge.

Potential venture investors usually have multiple questions during the due diligence process:

- What are the problems solved by the product?

- Where are the potential risks to the business?

- How big is the market opportunity?

- What makes the founders think the product will be successful?

- How will the investment capital be used to achieve the product’s goals?

As the competition is high and the investors are attentive to financial benefits, convincing them requires a detailed financial plan, a long-term strategy, and validation of the idea. Validation may be completed based on existing statistics or unique user surveys.

Finding a great investor

Having a great investor is beneficial in every way. The startup can get enough funding to realize all plans, additional expertise for the case, and keep its freedom of development, whether it's looking to create a budget app or a product in other fintech domains.

Here is where a fintech startup can find a great investor:

- Kickstarter, Angellist, Gust

- Business summits and similar networking events

- Startup accelerators

The next issue is to keep the investor’s attention. There are thousands of startups waiting for funding, so standing out from the crowd is obligatory. Preparing a comprehensive pitch deck presentation will provide the investor with all the required information to make a decision.

Here is what should be included in a pitch deck presentation:

- Brief company overview

- Problem and its solution

- Market opportunity and target audience

- Expected business model

- Financial estimations

A great strategy is imagining yourself as an investor. Think of all the questions that one might have when studying your project. Line them out and give an answer in your presentation.

Competing with huge brands

A modern startup has to compete with financial powerhouses like PayPal and technological giants like Amazon.

If the startup aims to be a B2C solution, it must find a market where tech giants are the weakest. This could be an area where consumers don’t receive enough offerings or are dissatisfied with the current services.

In the B2B segment, the startup must solve a significant issue related to digital finance transformation to be noticed. It could cover potential pain points like huge expenses, regulatory fines, or even ease of use. Any option is great as long as it meets the business needs.

5 challenges in fintech for incumbents

We have researched the major fintech industry challenges and chose the most significant ones. Many established companies struggle dealing with them, so we will also provide a solution to each.

Data security

There were 1,862 data breaches with an average cost of $4.24 million in 2021. This is a new all-time high, leading to even bigger concerns regarding cybersecurity in banking.

Companies must be aware that they risk losing not only their reputation, but also their money.

To prevent a potential breach, you have to build a fintech app that includes these features:

- Two-factor authentication

- Biometric authentication

- 256-bit AES encryption

- Notifications about all actions

Performing regular penetration tests is a good way to ensure hackers won’t disrupt your solution. You must have at least one test per year. Also, tests must be performed after each new update and integration.

Regulatory compliance

One of the challenges in fintech is the fact that this high-risk industry is ridden with government regulations. Companies must adhere to a number of laws such as the GDPR, GLBA, the Wiretap Act, the Money Laundering Control Act, and many others.

There are different ways to comply. Here’s what you can do:

- Hire a legal consultant for guidance

- Hire a dedicated person or department to keep track of the regulatory updates

Both options are viable. The only differences are the collaboration and pricing models. Using the services of a lawyer is much cheaper than paying a fine with the GDPR’s maximum penalty reaching €20 million.

Lack of tech expertise

Many banks and financial companies use outdated software or struggle to innovate in the area of mobile banking. This is a significant issue because their apps aren’t user friendly and intuitive. Although we may currently witness the constant focus shift to providing a better user experience, the process is still lengthy.

The following features are must-haves for any mobile financial app:

- A top-notch UI and UX

- Comprehensive data visualization

- QR-code payments

- NFC support

You can use fintech application development services to get a team of top-level experts working on your project. This will let you implement any feature to compete with the market’s leading players.

User retention and user experience

Keeping users engaged is one of the most common fintech challenges. Low retention means fewer users, resulting in reduced income.

Increasing user retention is possible by providing a better experience. Here are some examples:

- Gamification and a reward system

- Custom push recommendations

- User-friendly UI/UX

You can monitor the approaches used by your competitors to see how they impact the user experience. Seeing different methods in practice will help you choose the best options for your startup.

Service personalization

Companies shouldn’t neglect the importance of personalization.

Here are some ways to personalize your fintech software:

- Push notifications with usernames, topics of interest, and geo-based data

- Filtering by services and products the user was interested in previously

Personalization usually implies the usage of AI to determine a consumer’s interests. Artificial intelligence is among the most demanded fintech development services now, so it is worth considering.

DON’T LET THE CHALLENGES OVERWHELM YOU

Hire an experienced fintech development team to make your startup the next unicorn.

Top 5 opportunities in fintech

The number of opportunities is abundant, so we’ve hand-picked the five most prominent technologies to use.

Blockchain

A recent forecast predicts that the global blockchain market is expected to reach $22.46 billion by 2026, growing at a CAGR of 72.99%.

The technology removes third parties from transactions, provides a decentralized network, and creates digital ledgers. These features solve many challenges in fintech outlined above.

Artificial intelligence

AI has already been used in fintech for some time. In the majority of cases, it was implemented for real-time fraud detection and finance analysis.

Here’s what can be done with AI in fintech:

- Advanced cybersecurity and suspicious activity analysis

- Improved customer experience via chatbots and personalized services

- Risk score profiling, and more

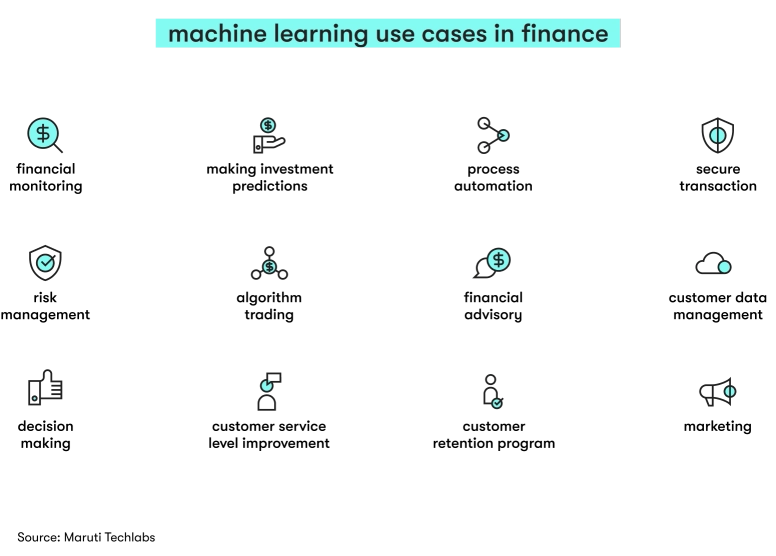

Machine learning

Machine learning is among the leading fintech opportunities and challenges in terms of implementation. It helps AI adapt to new situations and identify patterns.

Here is how machine learning is used to solve fintech issues:

- More loan approvals with fewer risks

- Fraudulent activity detection

- Regulatory compliance analysis

- Price prediction for stock trading, etc.

Big data

Big data helps companies in the financial data to get accurate information about their customers to adapt strategies and personalize UX.

Here’s how big data is used to mitigate the major issues with fintech:

- Creating detailed user portraits for adapted services and marketing strategies

- Improved risk assessment by analyzing multiple sources

- Accurate fraud detection systems development

Big data development services can help you get the most from this technology. Combined with AI and ML, it forms a powerful fintech ecosystem.

Web3

Web3 is a new blockchain-based version of the Internet with a focus on decentralization, AI, ML, and a better user experience.

Here’s how Web3 will change the fintech industry:

- Improved data control for users

- Access to any information for activities like BNPL or loans

- Personalized and adapted content

- Process automation for faster payments

- Minimized errors and suspensions

Traditional banking systems will take ages to adopt the new concept. Web3 and big data in fintech have all prospects for success.

START USING THESE OPPORTUNITIES TO YOUR ADVANTAGE

We can help you create a competitive fintech product with the newest technologies.

Top fast-growing fintech startups

The number of startups constantly grows, but only the best ones conquer the market. We have chosen the five leading startups that turn challenges in fintech into opportunities and win.

GoHenry

GoHenry is a debit card provider for children aged from 6 to 18 years old. The company has an application that aims to develop money skills in the younger generation. Children can learn how to get an allowance, save money, spend responsibly, and donate to charity.

Here are the key takeaways for this company:

- Type of startup: an educational money management platform

- 5-year search growth: 866%

- Valuation: $250-$500 million.

GoHenry’s application has an average rating of 4.3 out of 5 based on the reviews in Play Market and App Store. It has got over 1 million downloads worldwide.

M1 Finance

M1 Finance is an automated investment platform that helps people invest, borrow, and spend money. The company uses AI and ML technologies for its predictions.

Here are the key takeaways for this company:

- Type of startup: an automated investment platform

- 5-year search growth: 1,600%

- Valuation: $1.45 billion.

M1’s application has an average rating of 4.5 out of 5 based on the reviews in Play Market and App Store. It has got over 500,000 downloads worldwide.

Figure

Figure is a blockchain-powered service for individual users and huge companies. The company focuses on different types of loans, payment solutions, transaction services, and others.

Here are the key takeaways for this company:

- Type of startup: a loan and financial transaction provider

- 5-year search growth: 325%

- Valuation: $3.2 billion.

Figure’s application has an average rating of 3.5 out of 5 based on the reviews in the App Store. It has got over 5,000 downloads on Play Market.

Treasuryspring

Treasuryspring is a service that helps investors find the most cost-effective investment opportunities based on multiple factors. All data is accessed via a web portal.

Here are the key takeaways for this company:

- Type of startup: an investment assistance service

- 5-year search growth: 1,500%

- Total funding amount: $43.5 million.

At the moment, Treasuryspring does not have any mobile applications. The company provides its services through a browser-based application.

Revolut

Revolut is a service designed to be an alternative to the traditional banking system. It involves credit cards, payments, investments, currency exchange, insurance, and many other features.

Here are the key takeaways for this company:

- Type of startup: a banking services provider

- 5-year search growth: 1,257%

- Valuation: $33 billion.

Revolut’s mobile application has an average rating of 4.6 out of 5 based on the reviews in Play Market and App Store. The app has over 10 million downloads and is ranked 106 in App Store’s “Finance” section.

You may also be interested in the article on how to build your own payment gateway.

EPAM's experience in solving challenges in fintech

The developers at EPAM have hands-on experience in dealing with the biggest challenges of fintech. Check out the following case studies to see our solutions.

freeME: a solution to revolutionize pensions

Glarner Kantonalbank, a Swiss bank, came to EPAM with an idea to revolutionize Switzerland’s pension system. The idea was to let users control how their money is invested even while they’re in transition. This created freeMe.

EPAM's UX team conducted thorough research to make a user-friendly solution for the target audience. After that, the team built the freeMe application using modern web technologies to provide a rich and intuitive interface. You can read more about the solution here.

ImageNPay: creating carbon-neutral interactive digital payments

ImageNPay came to EPAM with the idea to create a digital wallet that could be personalized at any time. The main goal was to remove the need for issuing plastic cards, minimizing pollution.

EPAM's team supported the project from scratch by designing the architecture, creating an SDK, applying business intelligence, getting the PCI DSS certification, and completing many other stages. You can read more about the solution here.

Citi: transforming the customer-bank experience

Citi, one of the leading global banks, hosted a massive competition for developers. The idea was to create a cutting-edge solution that digitalized the bank system and easily integrated with Citi’s platforms. EPAM took on this challenge.

EPAM's team developed a solution that helps customers get a personalized experience. Simultaneously, Citi got a solution that let them gain deeper insights into their clients’ details. The bank was so impressed that they decided to integrate our solution into their Smart Branch. You can read more about the solution here.

LOOKING FORWARD TO BUILDING A FINTECH APP?

We’ll help you create a cutting-edge solution that complies with all legal regulations and uses modern technologies. Our team covers the full development lifecycle.

Summing up

The fintech industry has many benefits, challenges, and solutions. Among the leading issues, we may point out the lack of tech expertise and complicated regulatory compliance. However, these challenges can be easily overcome with the usage of modern technologies and a trusted financial software development partner.

While the traditional bank system slowly adopts modern solutions, the process is very time-intensive. Startups have all the potential to get the lion's share of the market by using blockchain, AI, ML, big data, and Web3 to their advantage. The usage of innovative technologies is one of the key elements to success.

FAQ

The Editorial Team of EPAM Startups & SMBs is an international collective of tech consultants, engineering managers and communications professionals who create, review and share their insights on business technology and project success tips.

The Editorial Team of EPAM Startups & SMBs is an international collective of tech consultants, engineering managers and communications professionals who create, review and share their insights on business technology and project success tips.

Explore our Editorial Policy to learn more about our standards for content creation.

read more